- Inventory Turn Rate

- Cost to Market

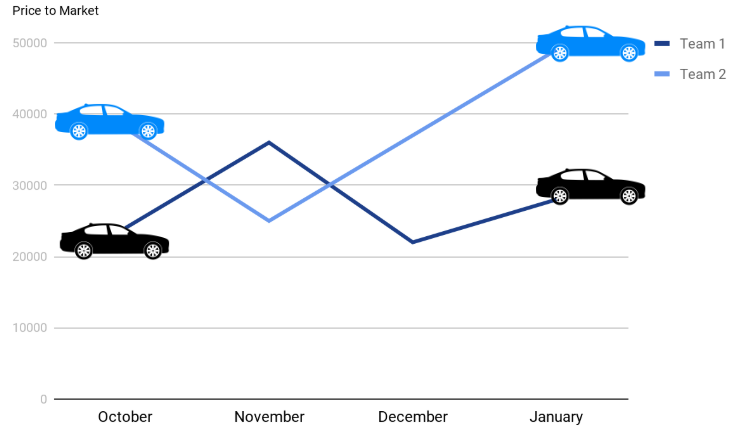

- Price to Market

- Reconditioning Time

- Aged Wholesale Loss

- Online Response Time

Whether you run a used car dealership in a manager-type position or work as a dealer at one, there are specific metrics that every dealer needs to track. Chances are, you’re already inundated with all sorts of reports and data. But as you’re gathering everything you need to evaluate your dealership’s performance, what are the metrics that matter most? Below is a list of 6 of the Key Performance Indicators (KPIs) and benchmarks for being considered “best-in-class.”

- Inventory Turn Rate: This is the amount of vehicle in-stock inventory compared to month-to-month sales. High-performance dealerships have an efficient workflow system between all departments working together to maximize the highest-gross possible. It allows for newer inventory to come in, and as a result, profit increases. The goal is to have a turnaround for your stock in just under three weeks.

- Cost To Market: As someone working in used-cars, you know each vehicle is an investment. Acquisition costs, reconditioning, transportation, service, reconditioning, and more all are an investment you make towards the cars you sell. By monitoring Cost To Market, you’re able to measure the vehicle’s retail value compared to the investment you made towards it. From there, you can find ways to minimize future costs and have an increased ROI on any of your used-car inventory.

- Price To Market: One website defined Price To Market (PTM) as, “…the way of adjustment of prices for different market(s)…” Measuring PTM allows for dealerships to find the window for maximum profitability on their inventory by measuring the value of a vehicle and its price. That way, you’re able to measure the best time to sell your cars for maximum gain. What dealer doesn’t want that?

- Reconditioning Time: Measuring reconditioning time is an essential part of running a used-car dealership. But what separates the top-performing dealers from the rest is their ability to have a fast turnaround time and know that time is money. Pay attention to any potential bottlenecked areas and see where you can improve the process. It may be as simple as acquiring better vehicles that will require less time in service and can hit your sales floor much sooner. Software can also help reduce reconditioning time.

- Aged Wholesale Loss: Not every vehicle that you recondition and offer at your dealership is going to sell. As a result, the money will be lost, which is relatively common in the used-car world. This is why allowing 5% for wholesale loss won’t put you out of business. However, this is not to say this 5% is to offset any losses. Look for what vehicles aren’t selling and find out why. From there, examine any areas that need adjustments to improve, so every vehicle is a sale.

- Online Response Time: With 95% of car buyers searching online for the new car purchase, your dealership website must cater to these digital customers. If you think of an online customer visiting your website as a customer actually at your dealership, you wouldn’t have them waiting an extended period before someone talks to them, right? You want to show the online customer right away they came to the right place and not let a dealership that responds faster be who they do business with.

If your dealership measures each of the metrics, you will be able to assess your dealership’s performance and find areas to improve. There is always room to grow, and luckily with the many tools available to us for tracking and gathering data, measuring KPIs will be one of the most beneficial things you can do for your dealership.