ReconMonitor

Valuable, Versatile, Vehicle Condition Reports

Knowledge is power, and you can’t know what you don’t know. These are two undisputed truths, and they are all you need to understand the importance of Vehicle Condition Reports. Think about your own business.… Read More »Valuable, Versatile, Vehicle Condition Reports

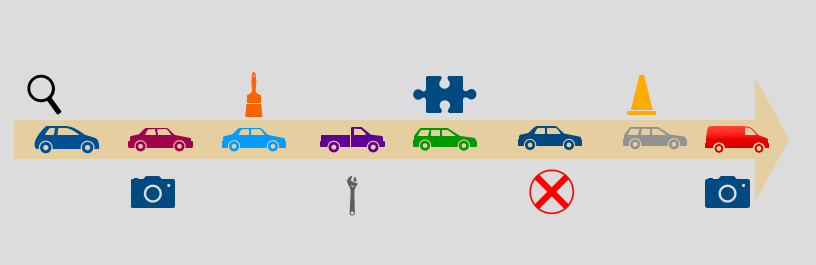

Does Your Dealership Workflow Need Improvement?

Making dealership workflows faster and more efficient lets you take advantage of more business opportunities. Here’s how to do that.

5 Tips For Operating A Successful Used Car Business

Running a business can be both an exciting and challenging time, and used cars are an increasingly popular choice among consumers. According to Auto Remarketing Magazine, over 40 million used cars were sold last year.… Read More »5 Tips For Operating A Successful Used Car Business

Do Used Car Customers Buy Old Cars? We Have The Answer.

Are you a dealership that automatically wholesales out all trade-ins more than three or four years old? You may want to reconsider. Why? Because you might be ignoring a large sector of the used car… Read More »Do Used Car Customers Buy Old Cars? We Have The Answer.

ReconMonitor Back Office 3.6.0

View service request list, search for service requests by specific details, approve, reject, and close service requests, edit service request contacts and vehicle information New Features Manage service requests Improvements Additional filter options for some… Read More »ReconMonitor Back Office 3.6.0

The Hertz Effect on Vehicle Sales

With the bankruptcy of Hertz Global Holdings, Inc., there will soon be an extraordinary volume of vehicles on offer, creating a bulge in a pipeline already constricted by the global pandemic. Hertz, down to their… Read More »The Hertz Effect on Vehicle Sales

ReconMonitor Back Office 3.5.9

The team of the currently assigned technician is automatically preselected when you change the technician assigned to the repair order phase Improvements Changing the status of matched parts to ‘Quote Received’ Showing preselected team when… Read More »ReconMonitor Back Office 3.5.9

Re-creating Your “New” Business

No matter how many years or how many generations your business has been in existence, you are starting a new business. Changes in our economy and society related to the pandemic have reset nearly everything… Read More »Re-creating Your “New” Business

ReconMonitor Back Office 3.5.8

Type the task name when adding a task to a repair order, and then select the appropriate task from the drop-down list with suggestions Improvements Use autocomplete search when adding tasks to repair orders Restoring… Read More »ReconMonitor Back Office 3.5.8