2018 has just begun and the economy looks to be off to a great start. A strong jobs outlook and low unemployment means more people are driving again, and these people are replacing their cars. You may have noticed this for a while now at your dealership.

But even with this increased demand, you still have to compete with the larger dealerships. One way to get ahead is to borrow tips and ideas straight out of their playbook. As a software company who sells to auto dealerships of all sizes, we have unique access to everything from a dealer’s operations to their accounting practices. We get to see behind the scenes of dealerships all over the country, and we know what makes the best dealerships successful.

As an independent dealership, you may not have the staff or even the time to always step back and look at the big picture of your operation, but it is an important exercise nonetheless. As you prepare your goals for 2018, you can’t make smart decisions until you take a long hard look at your company financials, and yes that means setting your budget.

Performing these budgeting tasks does not have to be a chore, in fact we are making it easy for you with this tutorial. Consider this budget to be a guideline, a scorecard or a report card for how you are doing financially as a business every month. It will help you make business decisions such as when to buy more inventory or how much to spend on advertising.

Building out your budget doesn’t have to be hard or even time consuming. Many of you are already using some form of accounting program and we have created an excel spreadsheet that you can use or modify simply by clicking the download here:

Get the Spreadsheet Template

Why you need a Budget for 2018:

- Determine your milestones so that you recognize when you pass them. You get into a routine. You have your auction days, you are involved in the remarketing needs of your purchases, you manage your sales people, you keep an eye on the finance department. But how do you know when you are ready for a second lot, or a third, if you don’t have a plan with set milestones? A good budget will help you find those milestones.

- You will need to borrow money, your bank will want a plan. If you do grow to that second location you may need to increase your floor plan. Your bank is going to want to see the plan, and how you expect to make your payments. A good budget will help you execute your business plan.

Business plans require financial projections, tax schedules, depreciation schedules, staffing plans and so on. All of this will be spread out over multiple pages and you will need to keep going back and forth between pages. I have found that the best way to start a business plan is to create a single page cheat sheet that has all the numbers in one spot. As you begin to fill in numbers in a business plan, it is helpful to have a single sheet that has all the numbers in one spot.

- A budget can help you make hard decisions quicker and easier. Scalable businesses are built on the backs of efficient processes. Time saving tips tricks and yes even software like our very own ReconMonitor will save you money. But how do you know when you can afford to invest in new equipment or software without being able to look at your own numbers? A budget will help with that. Your budget will help you determine whether you can afford every single business expense before making the purchase.

How to make a budget for your Independent Auto Dealership

The easiest thing is to create a Microsoft Excel spreadsheet. You can create your own or you can download our template below. On your spreadsheet include the next twelve months going from left to right in the top columns. Leave room in the first column to list out each expense.

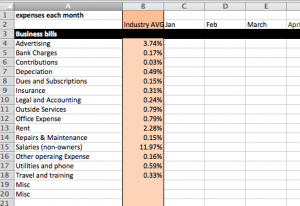

Next, in the first column, start labeling all of your expenses. It helps to have a couple of recent bank statements handy; you will be surprised at how many little expenses that you forget.

Start with your ongoing business expenses.

The way I like to do mine is start with the bills that you know that has to be paid each month, stuff like mortgage on your buildings or rent, utilities, etc. Put every business expense you have in there. This will give you a good idea of what you need at a minimum to pay break even. Now add a row for each of those columns to tally up.

Note: We have included a column with industry average percentages pulled from the NAIDA used car industry report.

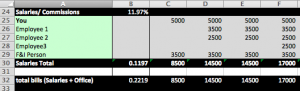

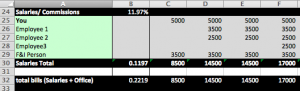

Next it’s time to start entering the employee expenses.

Begin entering values and lines for all of your employees, salaries and average commissions. Again review those bank statements and try to come up with a number for each type of expense that you have. Add a line to tally up each business expense by month.

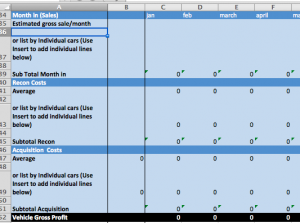

Inventory and reconditioning expenses are next.

Like most dealerships, you probably have a good bead on what sells in your market, and what your average reconditioning costs per vehicle are. This data can be pulled whether you do all your remarketing in house or you use outside vendors. If you use outside vendors ask for their help in determining an average per vehicle figure and use that as a multiple for how many vehicles you plan to buy in a given month.

Customers

Here is where the business owner’s crystal ball comes into play. Obviously, you can’t predict what cars will sell at exact times, but as an existing and successful dealership, you probably have your own data and formulas.

The purpose of this part of exercise is to start determining what revenue is coming in and when. If you offer repairs and service in addition to used cars, you probably have a good idea of what the revenue from the shop is each month as well.

Note: Our spreadsheet gives you the option to use a monthly average/projection, or you can enter specific cars if you want to get really accurate and track your performance.

Spreadsheet Formulas.

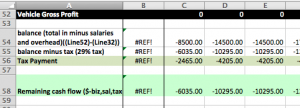

Next you will need to create a few formulas. First you want to create a line that totals your office overhead along with any salaries.

Subtract this number from the total sales in per month, and you have a fairly accurate idea of what revenue is left for taxes.

Next take this number and apply the following formula: =C54*(1-29%) In is case C54 is the cell with our remaining net cash after salaries office expenses and inventory expenses. This formula takes your net cash and subtracts 29%, which is a pretty good approximation for a small business tax burden and includes state taxes. We recommend that you speak with your tax professional to figure out what the percentage it for your specific situation. Whatever tax rate they suggest simply replace the 29 in that formula with the new number.

In the line below this, add the formula =SUM(C54)-(C55). This gives you the monthly tax payment that you will owe (even though you will pay quarterly). In this instance C54 is the net income and C55 is the tax payment.

Keep in mind this spreadsheet is designed to give you a quick and pretty accurate picture of your cash flow month by month, but it does not factor in things such as depreciations, etc.

We hope you found this to be helpful and we look forward to helping you achieve a prosperous 2018.