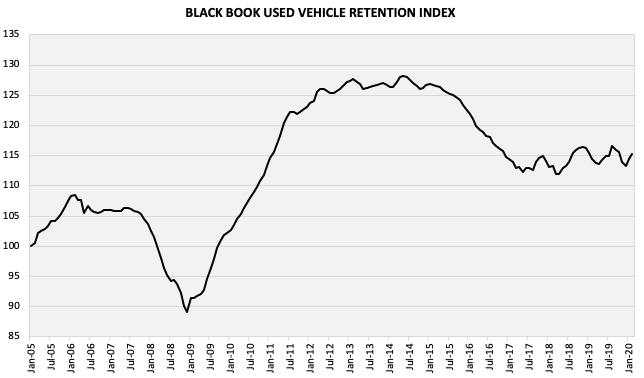

If your used car dealership uses Black Book trends, then you know that they reported a modest rise month-over-month in sales (0.7%) in February. Interestingly, they also identified a couple of elements in its February Used Vehicle Retention Index that they found to be surprising.

What was so surprising? Trucks sales did not increase, but luxury vehicles did.

“The surprising change was the near-luxury car and luxury car segments that had the largest month-over-month change; however, these were no change and lower, respectively, on a year-over-year basis,” said Black Book senior vice president of data science Alex Yurchenko.

Black Book Used Vehicle Retention Index is calculated using Black Book’s published wholesale average value on 2- to 6-year-old used vehicles, as a percent of original typically equipped MSRP. It is weighted based on registration volume and adjusted for seasonality, vehicle age, mileage, and condition.

Spring Buying Trends

- Volume-weighted, overall car segment values increased by 0.05% this past week. This change is the largest positive change since the end of August 2019 at 0.06%.

- Sporty Cars are continuing their upward momentum with another increase of 0.28%, as compared to the prior week’s increase of 0.38%.

- Volume-weighted, overall truck segment (including pickups, SUVs, and vans) values decreased by 0.01% last week.

- In trucks, the Sub-Compact Crossover segment increased for a fourth week in a row.

Now just a week or two of data point changes is not enough to change to spot a trend necessarily, but it is something worth keeping an eye on. As automakers like Ford ad Chevrolet kill off all their cars and switch to SUV’s the used car lots are the only option besides individual sellers to obtain a car vs. a truck or SUV.

For those dealerships banking on truck sales, take note that the subcompact truck segment saw increases for four weeks in a row. The midsized pickup segment in the US has grown for six consecutive years, and the total annual volume of new vehicle sales for this class has improved from 244,300 in 2013 to 639,200 in 2019, which is more than 2.5 times in those six years. Vehicles in this category include the Ford Ranger, The Jeep Gladiator, the Chevy Colorado, the Honda Ridgeline and the Toyota Tacoma.

‘Sporty Cars’ are also increasing in growth, which is another trend to watch. In a strong economy, more people are able to afford less practical things such as sporty cars. If you used car mix has avoided these in the past, it may be time to mix some sportier models into the mix.

As with any used car sales, there is no crystal ball to predict what to buy, remarket, and sell. But following the data week to week as closely as a stockbroker watches the stock market can show you areas where it might be worth taking a little risk with your floor plan.